Previous Winners

Previous Insurance person of the year

Previous Rising Star

Previous Insurance person of the year

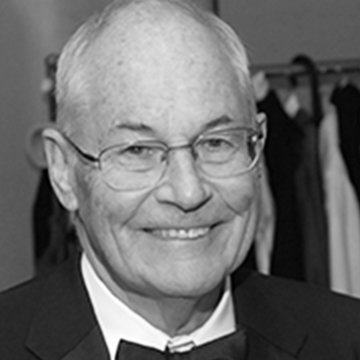

1992 Insurance Person of the year

John Glavin

“Don’t waste time learning the tricks of the profession; instead, learn the profession. And learn to listen – opportunity sometimes knocks very softly.”

The first-ever Insurance Person of the Year was awarded to John Glavin on Oct. 15, 1992, at the Pan Pacific Hotel in Vancouver. John was humbled to receive the award, which he treasured in his later years as he maintained contact with a vast number of former employees and colleagues who continued to seek his advice on both personal and professional matters.

John Glavin was born Feb. 12, 1925, and raised in Ottawa. On turning 17 in 1942 he joined the war effort and served in the Canadian Army, Royal Canadian Air Force, and the Royal Canadian Naval Volunteer Reserve. His service in the latter took in him into the North Atlantic theatre until his discharge in 1946. John was awarded the Volunteer Service Medal, the Atlantic Star, the British Defence Medal, and the Victory Medal.

John worked steadily anywhere work was available in the post war years until he began a 40-year career in the general insurance industry with the Dominion of Canada General Insurance Group in Ottawa, Winnipeg, and lastly in Vancouver. John was appointed General Manager of the company's BC branch in May 1956, a position he held until 1991 when he was appointed a Director of the Dominion of Canada in his last year before retirement. John continued his work within the general insurance industry when he was appointed a life Chartered Arbitrator (C.Arb.). He spent many years adjudicating industry conflict where he earned the respect of all who appeared before him for his firm but fair approach to arbitration and his well-reasoned decisions and awards.

“The general insurance industry as we know it is one generation away from extinction,” John said in accepting the Insurance Person of the Year award. “It’s important to remember that and to continue our pledge of personal service to our clients and to the public at all times to prevent it from happening.

“Say thank you a lot, say please a lot. Make new friends and cherish old ones. A great attribute of our lives is the gift of friendship – I have never taken this gift for granted and it’s something I reassure very much.”

John said the principle of utmost good faith that exists among brokers, insurers, and independent adjusters is “the golden thread which waves its way through the fabric of the general insurance industry.”

John married Elizabeth in Roblin, Manitoba, in 1957 and they built a home in North Vancouver where they raised three children: Christine, Gibson and Jim. When John fully retired in his 70s, he and Elizabeth travelled extensively well into their late 80s. John's final few years were spent at the Lynn Valley Care Centre in North Vancouver, with Elizabeth still at his side where they shared a suite. He died Dec. 31, 2021.

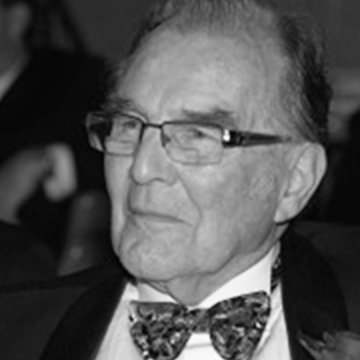

1993 Insurance Person of the year

Ron Newcomb

Ron Newcomb joined Kernaghan Adjusters in its founding year and worked tirelessly alongside Stan Kernaghan. They were known as “the twin towers,” and their strengths balanced each other as they built a formidable team across the country – the first national independent adjusting firm in Canada.

Born Feb. 27, 1930, and educated in Winnipeg, Ron began his insurance career with the General Accident Group in 1947 as a junior clerk; one of his many duties was to carry ice blocks up from the street into the office. In 1948 Ron transferred to the claims department and worked closely under the direction of Stan Kernaghan, the company’s Claims Manager for central Canada.

In 1951, he was transferred from the Winnipeg office of the General Accident to the Vancouver office and eventually was promoted to branch Claims Adjuster in 1952.

The quality of reports received from independent adjusting firms led Stan Kernaghan to believe he could do better. In 1953 Stan left the GA and started S.J. Kernaghan Adjusters Limited. Shortly thereafter he invited Ron to return to Winnipeg and the new firm. Ron became its General Manager in 1965 and Vice-president in 1968.

In 1974, Ron returned to Vancouver where the head office is now located and in 1980 became President of the company until 1993. Ron continued to work part-time for many years and retired as Executive Director of the company.

In the early days Ron was known as “the whip” to many of the young adjusters. He worked closely with them to instill the right values and work habits that would differentiate the team from the competition. To the industry and his friends, he was known as “Newc” and in later years, especially to the Kernaghan family, as “Uncle Ron”.

Ron loved boating and had several yachts over the years. He was a long-time member of the Burrard Yacht Club and was commodore 1997-1998.

Ron was kind, insightful, and above all a man of his word, someone you could trust implicitly. He had endless energy and always extended a helping hand to others. He participated in numerous industry associations and groups such as from the provincial Insurance Institutes of Manitoba and BC. In addition to being honoured as the 1993 Insurance Person of the Year, Ron was recognized with an Award of Merit from the Insurance Institute of BC. He served as Chair of the Insurance Institute of Canada in 1985-86.

He was President of BC Insurance Adjusters' Association, the Toastmaster Club in Winnipeg, and the of The Honourable Order of the Blue Goose in Manitoba and BC.

He coached minor hockey in Winnipeg for 15 years and was a minor soccer manager in North Vancouver for seven years. In addition to being honoured as the 1993 Insurance Person of the Year, Ron was recognized with an Award of Merit from the Insurance Institute of BC.

Ron and his wife Donna had three daughters – Valerie, Beverley and Janice – and twin sons David and Daniel. After 45 years of marriage, Donna died in 2001. Ron passed away August 29, 2017, at the age of 87.

1994 Insurance Person of the year

Jack Hamilton

Through his leadership of brokers’ associations, John F. (Jack) Hamilton helped create the organizational structure and unified voice that has established the modern insurance broker profession.

Born in Vancouver, he attended Kitsilano High School and earned a Bachelor of Commerce degree from the University of BC. While in university he obtained his insurance agent’s licence – one of the youngest people to do so at the time – and worked part-time in his father’s brokerage, William F. Hamilton Insurance. In 1955 at age 20 years old, he took a full-time position in the brokerage, which was later to become Hamilton Delong Ltd.

Jack Hamilton’s immense contribution to the industry started in 1971 when he became President of the Greater Vancouver Insurance Brokers Association. In 1972, the BC New Democratic Party, led by Dave Barrett, formed government and wasted no time in making good on their promise to reform auto insurance.

In 1973 Jack was sworn in as President of the Insurance Brokers Association of BC (IBABC); it was then known as the Insurance Agents Association of BC.

In February 1974 the Insurance Corporation of BC (ICBC) sold its first insurance policy. The growing pains for insurance brokers that accompanied the creation of ICBC led to Jack serving an unprecedented 26-month term as provincial broker association President from March 1973 to May 1975. Jack was instrumental during this period in educating MLAs and bureaucrats about brokers’ value to the insurance transaction.

ICBC’s Manager of Field Operations John Hancock said, “Jack Hamilton is one of the few people I know who has devoted his life to the insurance business,” Hancock said. “He played a big part in negotiating a strong position for brokers when ICBC was formed back in 1973 and over the years the success ICBC has had in delivering auto insurance has been due to IBABC – and that means Jack Hamilton.”

In 1978 Jack became President of the Insurance Brokers Association of Canada. He also served as a Director of the Insurance Council of BC. In 1986, he was hired as IBABC’s General Manager and during his tenure IBABC grew in membership, increased it staff from three to 11, created an education department that was to be a major component of its operations, implemented the Broker Identity Program, and added to the association’s membership services and public affairs profile. He retired in 1996.

A lifetime member of the Musicians’ Association, Jack was an accomplished trombonist, having played with the Kitsilano Boys Band, Dal Richards’ BC Lions band, and the Vancouver Fire Dept. band. Jack was also President of the North Shore Association for the Mentally Handicapped.

Brian Stanhope, Regional VP, Insurance Bureau of Canada, described Jack as “the best friend insurance companies ever had.” When insurance companies were lobbying the BC government to turn over ICBC’s general insurance division to the private sector, “Jack Hamilton gave us the best support and counsel we could have wished for.”

David FitzPatrick, partner in the Victoria brokerage Megson FitzPatrick and 1990 IBABC President, described Hamilton as “a man of great presence who has used this attribute to be an excellent spokesperson for IBABC – when he is in a meeting or walks into a room, you know he is there. Jack has been absolutely devoted to the insurance industry and to IBABC and its members.”

Jack died June 14, 1998, after a valiant fight with cancer, survived by his wife Norma, sons David and Graham, and daughter Cindy.